In today’s fast-paced world, young professionals are continually seeking innovative ways to manage their finances efficiently. Enter Acorns, a revolutionary investing platform designed to simplify and enhance your financial journey. Acorns invest user money into diversified portfolios of ETFs based on individual investing goals and risk tolerance, offering a variety of investment options including core and ESG portfolios. This blog will explore how Acorns investing can help you achieve your financial goals with minimal effort, and why it has become a game-changer for young investors seeking to secure their financial futures.

What is Acorns?

Acorns is a financial wellness platform designed to help users save, invest, and grow their money effortlessly. By offering automated saving, investing, and spending tools, Acorns aims to make financial wellness accessible to everyone, regardless of income level. The platform emphasizes finding balance with what you have, making it a popular choice for those starting their investing journey. With over 13 million Americans having invested more than $22 billion through Acorns, it’s clear that this innovative platform resonates with individuals seeking to secure their financial futures.

How Acorns Works

Acorns simplifies the investing process with three paid-subscription plans, each offering a suite of investment, banking, and earning features. The app is designed for automation and financial simplicity, allowing users to build their portfolios effortlessly. Users can contribute to their accounts through Round-Ups®, percentage-based contributions from paychecks, recurring contributions, or lump-sum contributions. Additionally, Acorns partners with over 450 brands to offer bonus investments, providing users with even more opportunities to grow their wealth. This combination of automated investing and bonus investments makes Acorns a powerful tool for achieving financial goals.

The Power of Small Steps with Acorns

Acorns stands out in the investing world by offering a unique approach to building wealth. This platform allows users to invest spare change from everyday purchases, transforming small amounts into substantial savings over time. By rounding up transactions to the nearest dollar, Acorns automatically invests the difference, ensuring that every purchase contributes to your financial growth. It's no wonder that Acorns has become a popular choice for young professionals who want to start investing without feeling overwhelmed.

Key Features of Acorns Explained

Let's take a closer look at the essential features that make Acorns a standout tool in the world of automated investing.

Invest Spare Change Effortlessly

Acorns' signature feature, Round-Ups®, makes investing as simple as spending. By linking your bank account to Acorns, you can effortlessly invest small amounts with each purchase. For example, buying a latte for $3.25 means a $0.75 investment into your dedicated investment account. This automated saving approach ensures that your money grows without requiring active management.

Looking for an experienced Wordpress Development company?

Diverse Investment Accounts and Expert Curation

Acorns offers a range of investment accounts tailored to meet different financial goals. Whether you're saving for retirement with an Acorns Later retirement account or planning for your family's future with Acorns Early accounts, the platform provides expertly curated portfolios designed to optimize your returns. These portfolios consist of exchange-traded funds (ETFs) managed by industry leaders such as Vanguard and BlackRock, ensuring that your investments are well-diversified.

Banking and Financial Tools

Beyond investing, Acorns offers banking services, including checking accounts with no overdraft fees and competitive annual percentage yields, linked to investment accounts. Lincoln Savings Bank provides FDIC insurance for Acorns Checking accounts, ensuring your funds are secure. With the Mighty Oak debit card, every purchase becomes an opportunity to invest, making it easier to save and grow your wealth. This integration of banking and investing tools creates a seamless experience for users, allowing them to manage their finances from one convenient platform.

Acorns Checking Accounts

Acorns offers checking accounts that come with no overdraft fees and access to over 55,000 fee-free ATMs, making it a convenient choice for managing your finances. For Acorns Gold subscribers, the Mighty Oak debit card offers a competitive 3.00% annual percentage yield (APY) on checking accounts, enhancing your savings potential. These accounts are FDIC-insured up to $250,000, providing an added layer of security and peace of mind. With these features, Acorns checking accounts seamlessly integrate banking and investing, helping you grow your wealth with every transaction.

The Benefits of Investing with Acorns

Acorns investing isn't just about convenience; it offers a range of benefits that cater specifically to the needs of young professionals.

Automation for Effortless Growth

One of the most significant advantages of Acorns is its automation. By setting up automated recurring investments starting at as little as $5, users can steadily grow their wealth without needing to actively manage their investments. This feature is especially beneficial for busy professionals who may not have the time or expertise to monitor the stock market daily.

Community Impact and Bonus Investments

Acorns fosters a sense of community among its users, encouraging them to achieve their financial goals together. The platform also partners with various brands to offer bonus investments, allowing users to earn additional contributions to their accounts when they shop with participating retailers. This unique feature enhances the value of Acorns, giving users even more reasons to stay engaged with their investments.

Comprehensive Savings and Retirement Planning

With Acorns, users can plan for their futures with confidence. The platform’s retirement account options, such as the Acorns Later retirement account, offer tax advantages and tailored investment strategies designed to maximize long-term growth. Additionally, Acorns’ investment tools and resources help users develop effective investment and savings strategies, ensuring that they are well-prepared for life’s unexpected hiccups by balancing spending, saving, and investing for overall financial wellness.

Fees and Pricing

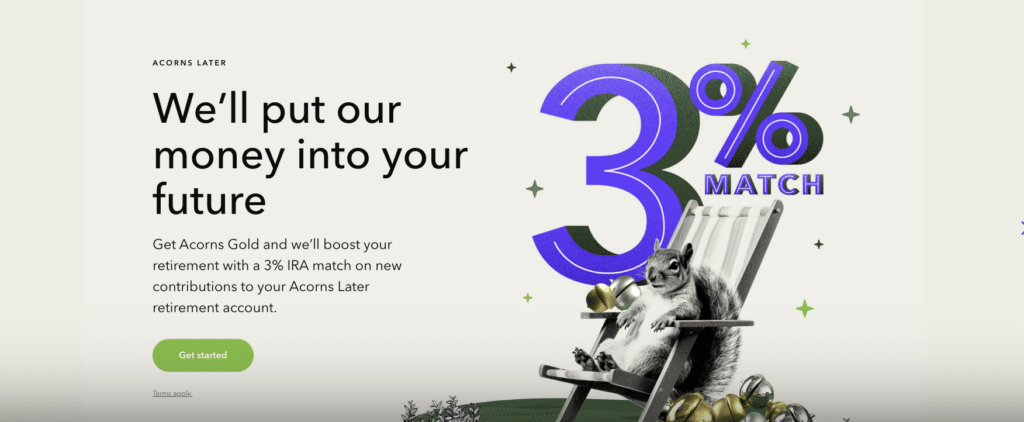

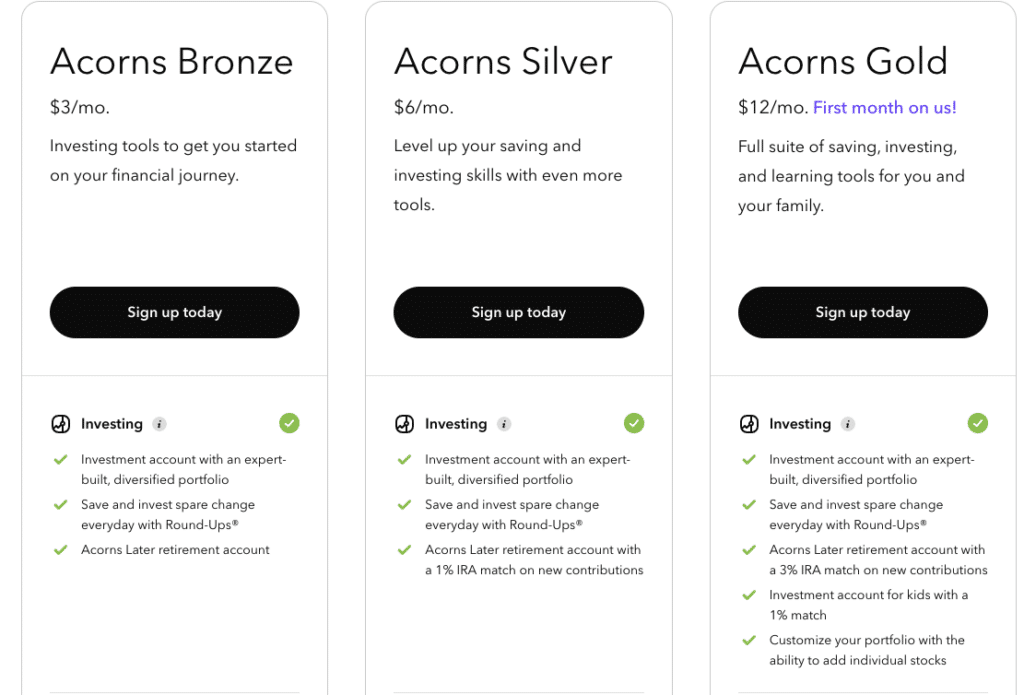

Acorns offers three subscription plans to cater to different financial needs: Bronze, Silver, and Gold. The Bronze plan, at $3 per month, includes essential investing tools to get you started. The Silver plan, costing $6 per month, builds on the Bronze plan by adding a 1% IRA match on new contributions to the Acorns Later retirement account.

The Gold plan, priced at $12 per month, offers the most comprehensive benefits, including a 3% IRA match on new contributions to the Acorns Later retirement account, investment accounts for kids with a 1% match, and a GoHenry debit card and learning app for kids. Acorns Gold subscribers automatically get an Acorns checking account and access to investing experts Acorns Gold style. These tiered plans ensure that users can choose the level of service that best fits their financial goals.

Getting Started with Acorns

Starting your investment journey with Acorns is quick and straightforward. In under five minutes, you can sign up for an account online or through the mobile app. Once registered, link your bank account or credit card to begin investing. Acorns offers a variety of investment options, including ETFs and individual stocks, allowing you to tailor your portfolio to your preferences. You can choose to invest spare change through Round-Ups®, set up recurring investments, or make lump-sum contributions. With its intuitive interface and automated investment options, Acorns makes it easy for you to start growing your wealth and achieving your financial goals.

Acorns Gold Unveiled

For those looking to take their financial game to the next level, Acorns offers a premium subscriptionservice known as Acorns Gold. Let's explore what makes this option so appealing to young professionals.

Boost Your Retirement with Acorns Gold

Acorns Gold subscribers benefit from a 3% IRA match on new contributions to their Acorns Later retirement accounts. This valuable perk accelerates users' progress towards their retirement goals, making it easier than ever to build a secure financial future.

Investing in Kids' Futures with Acorns Early

Acorns Gold opens the door to investing in your children's futures, providing a dedicated investment account for kids with features like the teen debit card from GoHenry. This unique offering empowers parents to teach their children about financial responsibility while setting them up for long-term success.

Exclusive Features for Gold Subscribers

In addition to enhanced retirement and educational offerings, Acorns Gold subscribers receive access to exclusive features such as custom portfolio options and priority customer support. These benefits elevate the investing experience, providing users with the tools and resources they need to thrive financially.

Safety and Support You Can Trust

When it comes to managing your money, security is paramount. Let's explore how Acorns protects its users and ensures a seamless experience.

Robust Security Measures in Place

Acorns takes user security seriously, employing industry-standard measures such as 256-bit data encryption and fraud protection to safeguard your financial information. Furthermore, Acorns investment accounts are SIPC-protected up to $500,000, providing peace of mind for investors.

FDIC-Insured Banking Services

Acorns Checking accounts are FDIC-insured up to $250,000, ensuring that your funds are safe and secure. This level of protection, combined with features like all-digital card lock and overdraft fee waivers, makes Acorns a reliable choice for managing your finances.

Dedicated Customer Support

Acorns offers exceptional support for its users, with a team of financial experts available to assist with any inquiries or concerns. Whether you're new to investing or a seasoned pro, Acorns provides the guidance you need to make informed decisions and achieve your financial goals.

Elevating Financial Literacy with Acorns

Acorns isn't just about investing—it's also a powerful tool for enhancing your financial literacy. Let's explore how the platform supports your financial education.

Educational Resources and Tools

Acorns offers a wealth of educational content, including finance terms definitions and money tools designed to help users develop their investing skills. From beginner-friendly guides to in-depth analyses, Acorns provides the knowledge you need to make confident financial decisions.

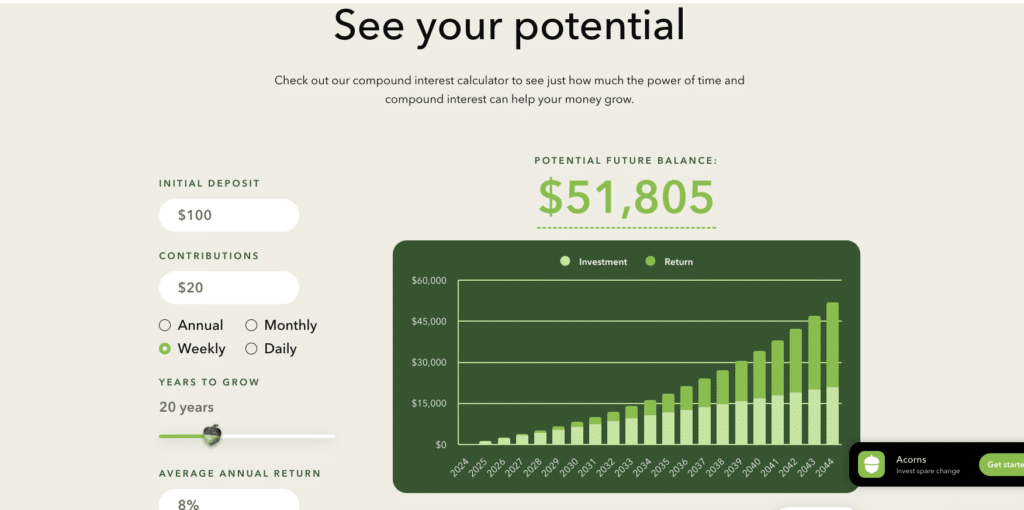

Practical Application through Interactive Features

In addition to educational content, Acorns offers interactive features like its compound interest calculator, allowing users to visualize the potential growth of their investments. These practical tools empower users to take control of their financial futures and make informed decisions.

Building Skills for Long-Term Success

By utilizing Acorns' educational resources and tools, users can build a solid foundation of money knowledge that will serve them well throughout their financial journeys. This focus on financial literacy sets Acorns apart as a comprehensive solution for young professionals seeking to grow their wealth responsibly.

Closing Thoughts on Acorns Investing

In conclusion, Acorns offers an unparalleled opportunity for young professionals to invest spare change, save for retirement, and enhance their financial literacy—all from one easy-to-use platform. With its automated investing features, diverse investment accounts, and robust security measures, Acorns has become a trusted ally for those looking to build a bright financial future.

Ready to take the next step? Start investing with Acorns today and watch your wealth grow from tiny acorns into mighty financial oaks. Join the movement and experience the power of automated investing for yourself.